Trade Workflow Automation

We connect the dots to save you time and allow you to focus on core activities. Our end-to-end service model reduces manual tasks and operational risks and standardizes your FX and Cash workflows.

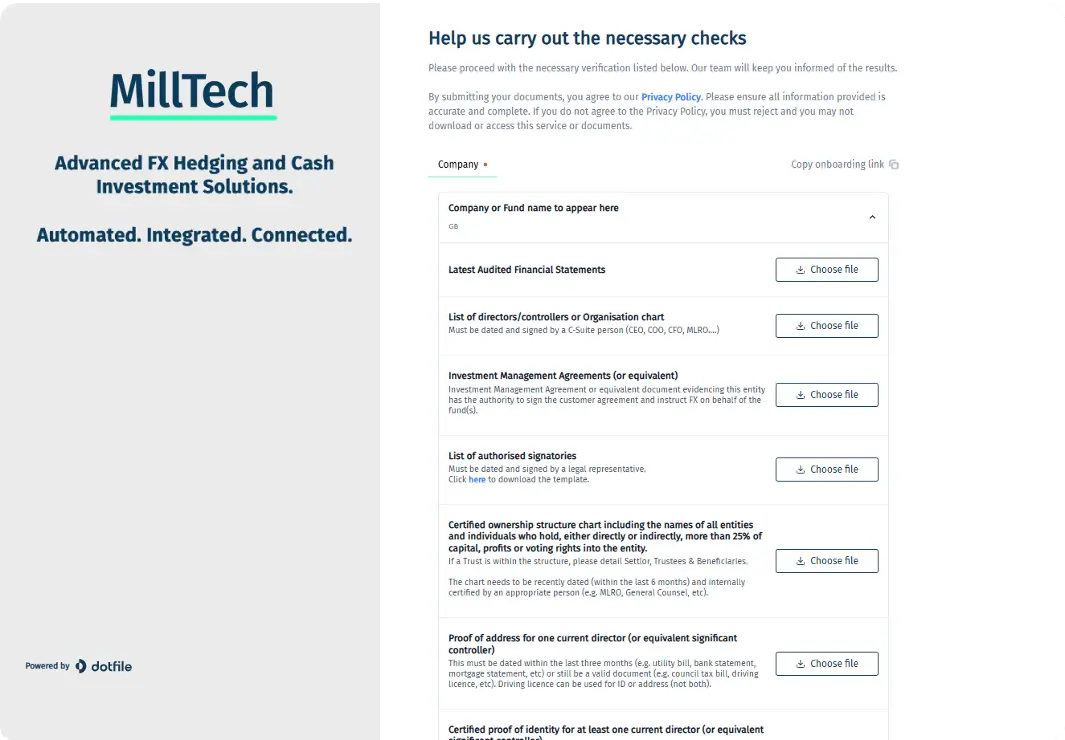

Onboard

Trade

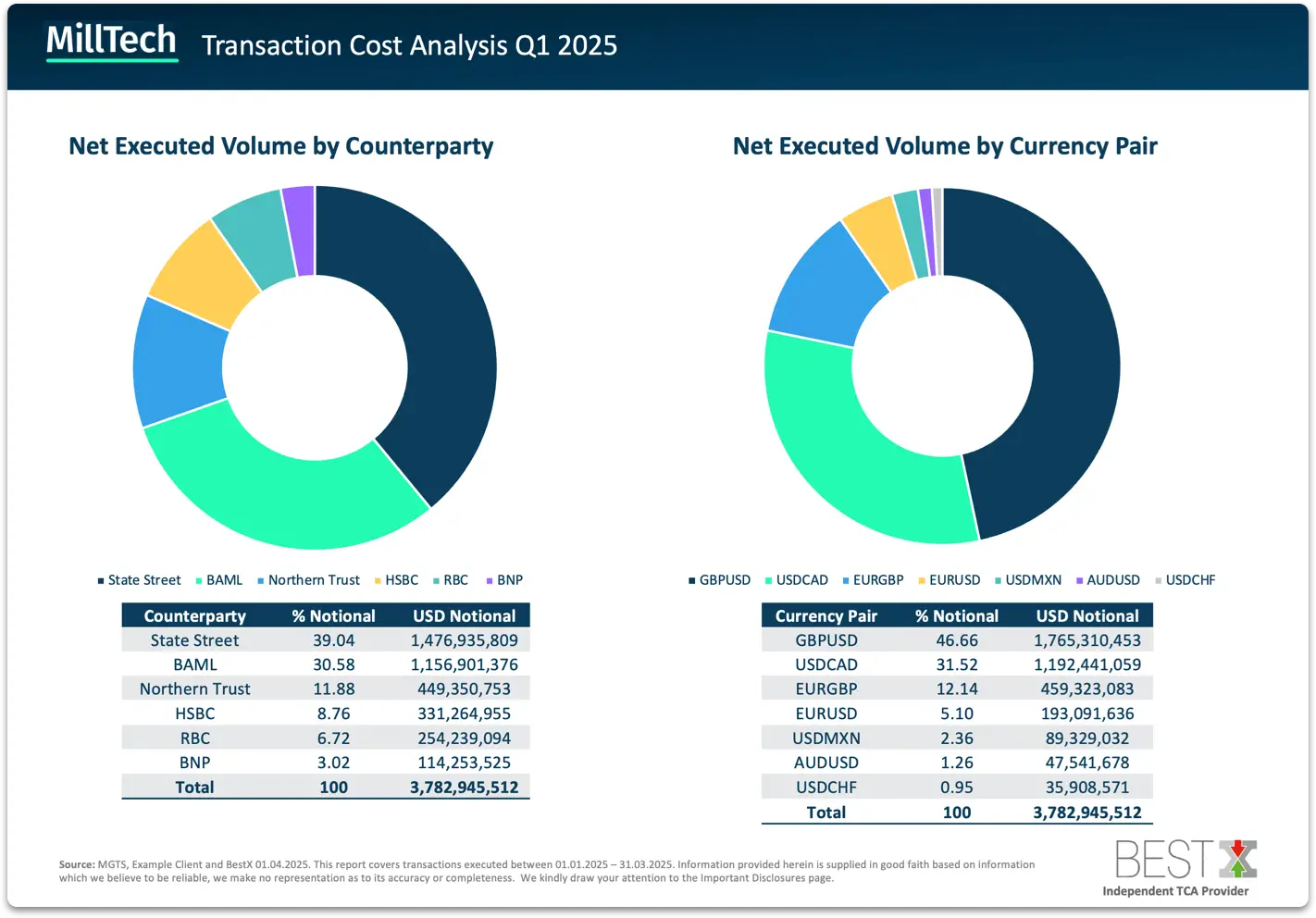

Report

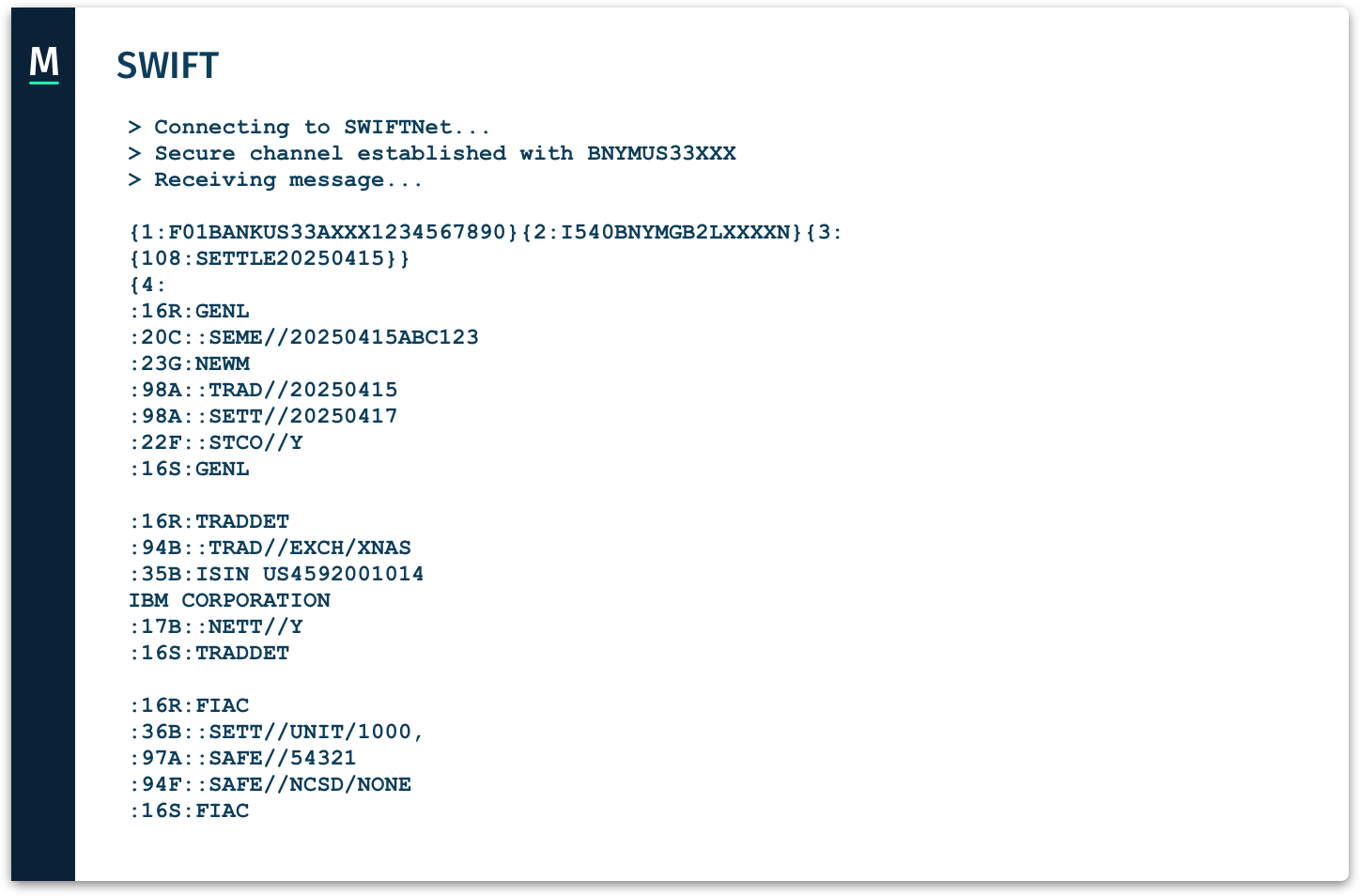

Settle

Audit

Onboard:Express FX ISDA and MMF onboarding via our marketplace of 15 Tier 1 liquidity providers

Trade:Execute via our platform, automate via API/FIX, or outsource execution and calculation

Report:Reporting packs are automatically distributed to your Admin, Custodian, PMS/TMS and Regulators

Settle:Settlements are automated instructed via SWIFT or CLS directly with you Custodian or Bank Account

Audit:All FX transaction costs are independently audited via TCA reports and yield data is published daily